“The building, construction and real estate sectors in India, currently employ around 33 million people. The bulk of that workforce, around 82.5%, constitutes of unskilled workers. Based on the growth expected in the infrastructure and real estate sectors, it is expected that about 83 million would be employed by 2022. The incremental human resource requirement between 2008 and 2022, is expected to be about 47 million, which is more than double the present number. The sector will further continue to employ a large portion of this human resource with low education profiles. Hence, skill level needs to be continuously upgraded.” Surajit Roy, Head – Skilling, CREDAI National

Why skilling the largely unskilled workforce in India’s construction sector is the need of the hour.

Comprising mostly of unorganised players, the construction industry in India is highly fragmented. Considering that the construction sector was the second largest employer in India in 2017, the second largest FDI recipient in India in 2017 and pegged to become the third largest construction market globally in 2025 [i], it comes as no surprise that there is tremendous activity on the ground which will require a suitably skilled labour force. Giving evidence to this is a report by the National Skill Development Corporation (NSDC), which estimates that India will need around 76.5 million workers in the various segments of the construction landscape, but only 4% of that is skilled. The construction sector is especially geared towards a young workforce given the nature of the industry. If we consider that by 2025 around 70% Indians will be of working age it will be a travesty if the shortage of skills continues and a unified scaled up effort is not taken to take advantage of this enormous human capital pool. From plumbers to machine operators, the skilling need is urgent to keep pace with India’s infrastructure development plans.

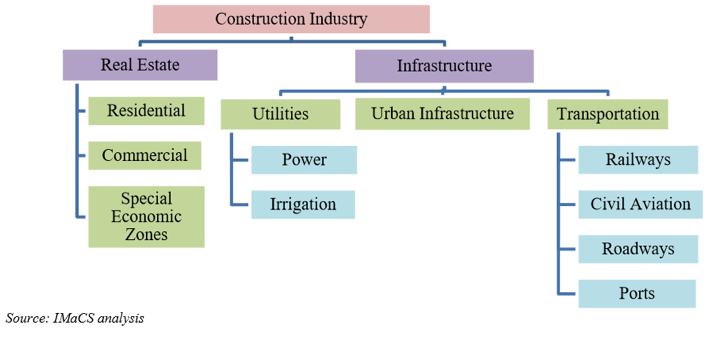

Indian Construction Industry Landscape

Policy Enablers & Growth Factors

- 100% FDI under automatic route is allowed in construction development which includes townships, housing, malls, built-up infrastructure (urban transport, water supply, sewerage).

- Construction Skill Development Council of India (CSDCI) has been set up under the NSDC to promote skills training in construction

- Cumulative FDI inflows in construction activities including infrastructure, reached US$ 12.36 billion between April 2000 – December 2017 and US$ 24.67 billion in the construction development sector, which includes townships and built-up infrastructure for the same period. [ii]

- In June 2018, the Asian Infrastructure Investment Bank (AIIB) has announced US$ 200 million investment into the National Investment & Infrastructure Fund (NIIF). [ii]

- Private equity and venture capital investments in infrastructure and real estate saw 29 deals in the first half of 2018, at a value US$ 3.9 billion, and 91 M&A deals worth US$ 5.4 billion in 2017.ii

The construction sector in India is vast and encompasses several sub-segments. We will be taking a snapshot of a few key areas and emerging trends which we hope will provide an overview of the role of vocational training in this sector.

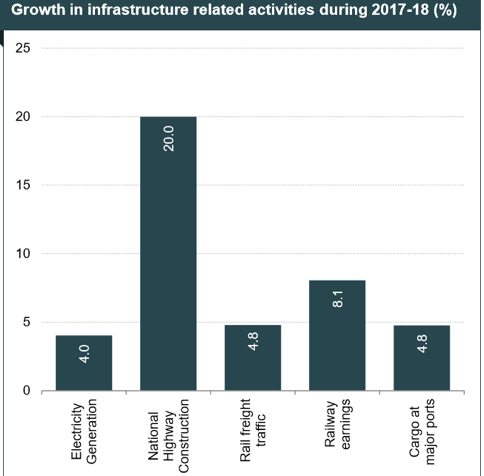

The Highways

Coinciding with the government’s renewed focus on logistics national highway construction recorded an increase of 23% CAGR between 2014-18 [iii] and is expected to cover 50,000 kilometres by 2019. [ii] An eye-popping US$ 10.97 billion was allocated in the 2018-19 Union Budget for national highways and US$ 2.94 billion for rural roads through the Pradhan Mantri Gram Sadak Yojana (PMGSY). [iii] The graph below represents fervent activity in highway construction in India with a 20% increase in 2017-2018 alone.

Housing for All

Rapid urbanisation in India has to keep pace with affordable housing for its teeming millions. The government seeks to provide decent living conditions to the poor through its flagship Pradhan Mantri Awas Yojana with a target of building 20 million affordable houses for the urban poor, and 30 million rural houses by March 2022. Assuming India will need to construct 43,000 houses every day until 2022iii, the demand for skilled workers will be sky high and unprecedented. CREDAI estimates that these schemes alone would require around 38 million workers by 2030.

Smart Living

The Smart City Mission launched in 2015, aims to develop the infrastructure of 100 cities (all identified as of June 2018) with a funneling of US$ 31.81 billion [iii] by 2022. Similarly, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) scheme plans to build 500 cities by 2022. Although plenty of skepticism exists in the current low momentum of these marquee infrastructure projects if they were to pick up speed to meet even half the target numbers the skill requirement will be massive.

Emerging Trends in Skilling

The NSDC estimates that only 4% of the total workforce employed by the construction and infrastructure industry has any formal training. An analysis carried out by NSDC-Aon Hewitt [iv] found that the top five skills (such as supervisors, foremen) required in the construction industry to sustain current momentum were not trained or licensed. In the absence of standardisation of industry accepted assessment and certification the current skillset of key roles including electricians and plumbers are not in sync with industry demand.

The NSDC-Aon Hewitt report has classified job roles as skilled, unskilled and semi-skilled. A skilled tradesman such as a mason or carpenter would have 4-5 years of industry experience. A semi-skilled tradesman will be in an apprenticeship under the mentorship of a senior craftsman from the skilled category.

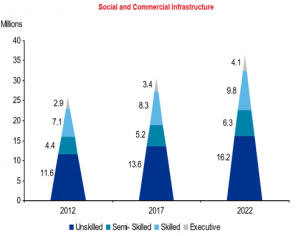

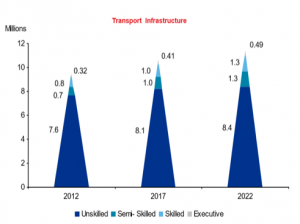

The impact of technological advancements and new construction methods such as plastering techniques, pre-fabricated and pre-cast parts is expected to bring about a dynamic change in the number and ratios of workers across skill levels as seen in the pyramids below. Echoing this trend, Mr. Surajit Roy, Head – Skilling, CREDAI National, states that 80% of the skill building requirement will apply to bottom of the skill pyramid, those with minimal education (plumbers, bar benders, welders, masons, electricians etc). [v]

Source: Talent Projections & Skills Gap Analysis for the Infrastructure Sector (2022), NSDC-Aon Hewitt

Roads and bridges which received an enormous cash injection in the last Union budget will require skills such as masons, welders, machine operators and drivers, bar benders and painters, among others. Additionally, a boom in the commercial and Retail sectors is making space for new skills in facilities management such as security guards, plumbers, electricians, housekeeping staff etc.

Conclusion

India has been heavily dependent on unskilled labour in its construction and infrastructure development projects. This has been to the detriment both to the quality of the projects and to lakhs of individuals who are losing out on becoming skilled tradesmen. As the country embarks on ambitious infrastructure development goals with the backing of whopping public and private funds it becomes imperative that workforce recruited to do the job are on par with the economic importance that this sector commands.

References

[i] National Investment Promotion and Facilitation Agency of India

[ii] Infrastructure Sector in India, Sep 2018, India Brand Equity

[iii] Infrastructure report, Sep 2018, India Brand Equity

[iv] Talent Projections & Skills Gap Analysis for the Infrastructure Sector (2022), NSDC-Aon Hewitt

[v] Is the Indian realty sector taking the skill gap problem seriously? Feb 7, 2017, Housing.com